With the Pro Plan, automatically import, merge, and categorize your bank transactions. Access your data anywhere, any time. It's always available, and it’s backed up for extra peace of mind.

Button-up your bookkeeping

Keep your books organized and accurate to make tax time suck less. Get started for free, or learn about our Pro Plan features below.

Accounting software that works as hard as you do

- Simple, reliable, and secure

- Easily manage cash flow

- Be ready for tax time

.webp)

Connect your bank accounts in seconds with the Pro Plan. Transactions will appear in your bookkeeping automatically, and you'll say goodbye to manual receipt entry.

Have an eye on the big picture so you can make better business decisions. Our robust small business accounting reports are easy to use and show month-to-month or year-to-year comparisons so you can easily identify cash flow trends.

Organized and stress-free small business accounting

Wave makes accounting as simple as possible.

Make tax time a breeze

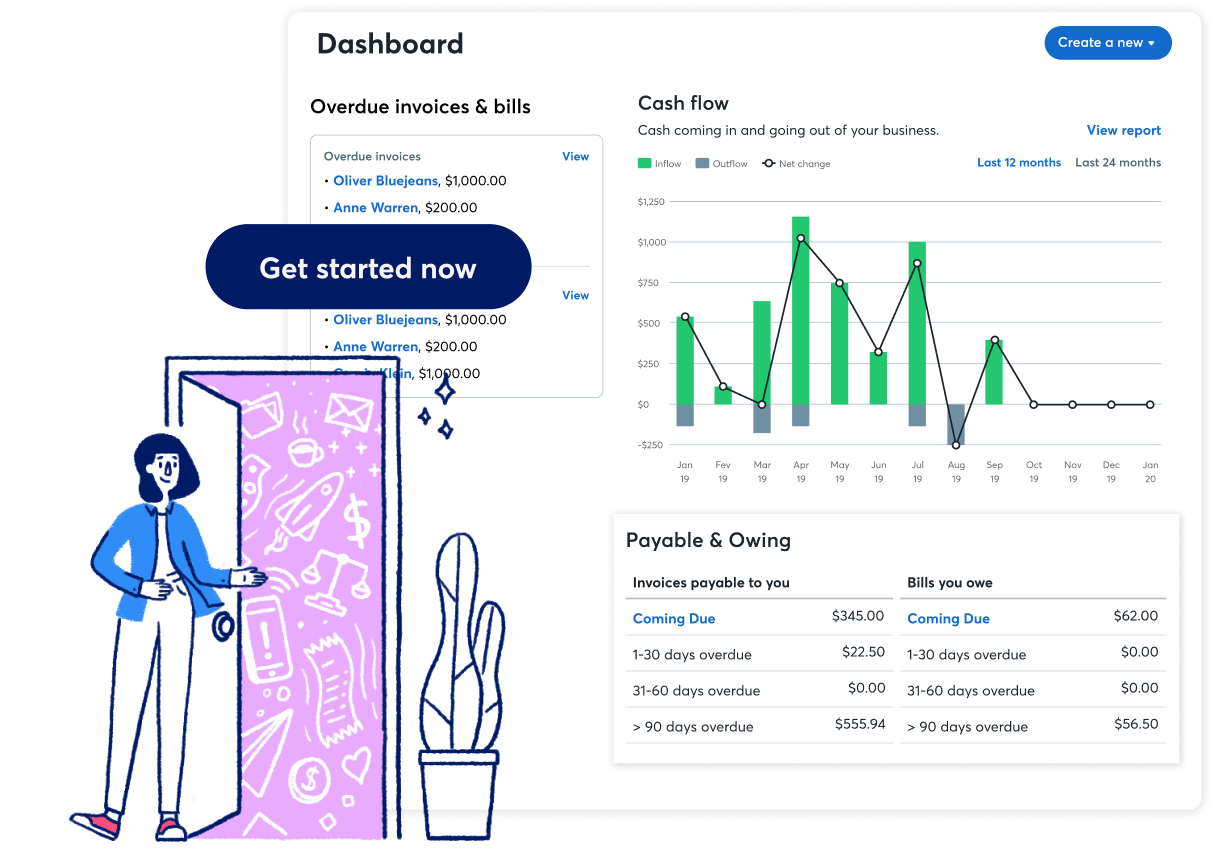

When everything is neatly where it belongs, tax time is simple. Wave’s smart dashboard organizes your income, expenses, payments, and invoices.

We’re serious about security

Bank data connections are read-only and use 256-bit encryption. Servers are housed under physical and electronic protection. Wave is PCI Level-1 certified for handling credit card and bank account information.

Accountant-friendly software

Wave uses real, double-entry accounting software. Don’t know what that is? No sweat. Accountants do, and they’ll thank you for it.

When I signed up with Wave it was a no brainer. It's been one of the best decisions I've made when it comes to making sure my accounting is on point.